If you have bad credit, you might be wondering if you can still purchase a home. The good news is that you can buy a house with bad credit, but there are a few things you need to know before doing so. For starters, your interest rate will be higher than someone with good credit. Additionally, you may have to put down a larger down payment than someone with good credit.

There are several things you can do to improve your chances of getting approved for a mortgage. For example, you can get a cosigner, put down a larger down payment, or study articles about the PEI real estate market (or wherever you are looking to move) thoroughly to find a less expensive home. You should also make sure to get pre-approved for a mortgage before you start shopping for homes.

Bad Credit Score: What Does It Mean?

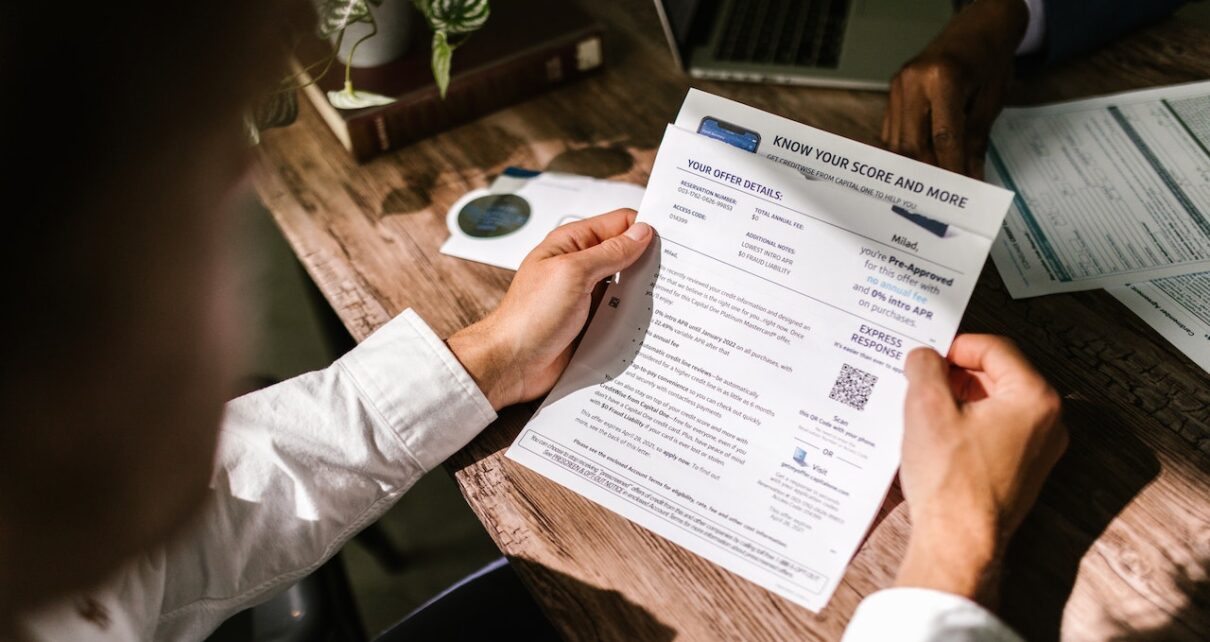

Bad credit can come back to bite you when you least expect it. If you’re considering buying a house, your credit score is one of the first things lenders will look at-and it could determine whether or not you’re approved for a loan.

A bad credit score is typically below 630 but can be as low as 300 on some scoring models. Your credit score is based on your credit history, which includes information like whether you pay your bills on time and how much debt you have. If you have a lot of debt or missed payments in the past, your credit score will suffer.

In order to get your credit score, you will need to contact one of the three main credit reporting agencies: Experian, TransUnion, and Equifax. They will each give you a report that includes your credit score. It is important to check your credit score from all three agencies because they may have different information on file.

Several things can cause your credit score to drop, including late or missed payments, maxing out your credit cards, having accounts sent to collections, or declaring bankruptcy. If you have a bad credit score, you may still be able to qualify for loans and credit cards, but you’ll likely pay higher interest rates and fees.

The Mortgage Process with Bad Credit

When you have bad credit, the mortgage process can be more difficult. You may have to put down a larger down payment, or find a cosigner.But what many people don’t realize is that there are still options available, even for those with less-than-perfect credit. Here’s a rundown of the mortgage process for those with bad credit.

The first step is to talk to a mortgage broker or lender. They’ll be able to tell you what type of loan you qualify for and what interest rate you can expect to pay. Be sure to shop around and compare rates from multiple lenders before making a decision.

Once you’ve found a lender you’re comfortable with, it’s time to fill out an application. This will include providing detailed information about your financial history and current situation. Be honest and upfront about your credit score and any past financial difficulties.

How Can You Improve Your Credit Score?

First, make sure you’re paying your bills on time. This includes both credit card and loan payments. Not only does this show lenders that you’re responsible with money, but it also helps keep your debt-to-income ratio low.

Additionally, try to keep your credit utilization low. This means using less than 30% of your available credit line. And finally, don’t open too many new lines of credit at once,, as lenders see this as a red flag.

By following these tips, you can start to see an improvement in your credit score. Remember, it takes time and consistency to see results, so don’t get discouraged if you don’t see a drastic change overnight. Just keep at it, and you’ll eventually see the fruits of your labor.

Conclusion

Although having a bad credit score may make the home-buying process more complex, it is still possible to buy a house. Mortgage advisors in Cheshire can help you in such a case. They will work with you to find a house you can afford and help you get approved for a loan. This is an excellent option for those who may not be able to get approved for a loan on their own.